can you work part time on disability 2021

You just have to make sure your income doesnt exceed the limitations for substantial gainful activity or SGA. For SSDI you can only receive benefits if you cannot work a full time job or enough to be considered substantial gainful activity 1350 per month 2260 if youre blind.

For example your health may improve or you might go back to work.

. Technically you can still be considered disabled if your earnings are under 1310 per month in 2021 or 2190 for blind applicants regardless of. If you have medicare part b. It is possible to work part time but this can make it harder to prove you cannot work full time.

The Social Security Administration SSA will look at a number of factors while they determine your eligibility for benefits. Can you work part time on disability 2021 Monday February 28 2022 Edit. You can work part time while on Social Security Disability.

Disability benefits are excluded from being calculated as gross income. Can You Work Part Time on Social Security Disability. Yes you can work while receiving Social Security Disability Insurance SSDI benefits but only within strict limits.

Social Security generally finds a person to be disabled if they cannot sustain full-time work on a regular basis. Working Part-Time If you work part-time you do not want to exceed the SGA limits. Payments will stop if you are engaged in what Social Security calls substantial gainful activity SGA as its known is defined in 2022 as earning more than 1350 a month or 2260 if you are blind.

Generally you have to quit your job before applying for benefits. However if you wish to do other rehabilitative work or a training course you must get written permission from the DSP called an exemption before starting. PASS Plans These plans to achieve self support provide benefits to those who want to begin working while on SSDI but need assistance meeting this goal.

This does not mean you cannot work part-time while applying for disability. Yes But Within Strict Limits. Continuation of medicare if your social security disability benefits stop because of your earnings but youre still disabled your free medicare part a coverage will continue for at least 93 months after the nine-month trial work period.

Therefore most recipients receive SSDI in place of working. Can you work part-time on. Some return-to-work incentives allow only part-time work.

If you continue to work full time Social Security wont even consider your claim because the agency will assume youre not disabled. In this case you can continue working part-time on disability while collecting full benefits as long as your earnings are not considered by the SSA to be substantial. You may be able to hold a part-time job while still receiving disability benefits although the amount of wages you earn could affect your situation.

However if the work performed before submitting an application for disability was only done on a part-time basis and Social Security believes you can still perform this type of work they may deny your claim. Yes you can work while receiving Social Security Disability Insurance SSDI benefits but only within strict limits. Even though youre working through pain if youre able to continue your job you wont be approved for disability benefits.

However this is not how long-term disability insurance carriers operate. If you are on SSDI already you cant start making the SGA amount regularly. Is SSDI considered gross income.

During this time youll continue to receive your full SSDI benefits. As of January 2021 the maximum federal benefit for an individual is 794 for an individual and 1191 for a couple per month. For 2021 the amount you can earn per month while drawing social security disability is 1276 up from 1260 in 2020.

You should also be attentive to the hours that you work. The SSA defines Substantial Gainful Activity SGA as any monthly earnings over 1260 except for those who receive disability for vision problems. If You Go Back to Work Publications Your Continuing Eligibility In most cases you will continue to receive benefits as long as you have a disability.

After those 9 months if you can return to work you will lose your disability benefits. For instance someone making the federal minimum wage 725 per hour can work 32 hours per week and have their earnings come under the SGA amount while someone who makes significantly more say 42 per hour can work only five hours per week without becoming ineligible for benefits. You can also do part-time work which is part of a treatment or charitable in character provided you do not earn more than 50 a week without permission.

This incentive will vary depending on the policy and may limit what type of work you can do. They must transfer to the Partial Capacity Benefit scheme if they wish to work. The short answer is yes.

Taxpayers who dont qualify for any of these three special situations can still get more time to file by submitting a. The SGA limits are adjusted each year based on the average wage changes. Others may allow you to work full-time but place limits on the amount you can earn and still receive benefits.

If you earn more than 880 per month it is considered part of your trial work period which you must report to the SSA. After that you can buy medicare part a coverage by paying a monthly premium. However there are certain circumstances that may change your continuing eligibility for disability benefits.

Several states add to that amount according to the Social Security Administration. The SGA amount is a set maximum monthly wage that helps the Social Security Administration SSA determine whether or not your disability prevents you from earning a living. Ad Social Security Disability Insurance Stops If You Earn More Than Certain Monthly Limits.

The total fluctuates annually. You need to earn a living while you are waiting to get approved for disability benefits though it may not always be in your favor to work during the approvals process. The Social Security Administration even allows for trial work periods that let you work for a time while receiving your Social Security benefits typically nine months in a rolling 60-month period.

During those 9 months you can receive your SSDI benefits while you work. And thats despite the official Social. Social Security benefits are a government program that focuses on.

What Conditions Automatically Qualify You For Disability Common Types That Qualify For Ssd Benefits Hardison Cochran

The Awesome Sample Psychoeducational Report Pdf Within Psychoeducational Report Template Image B Report Template Professional Templates Book Report Templates

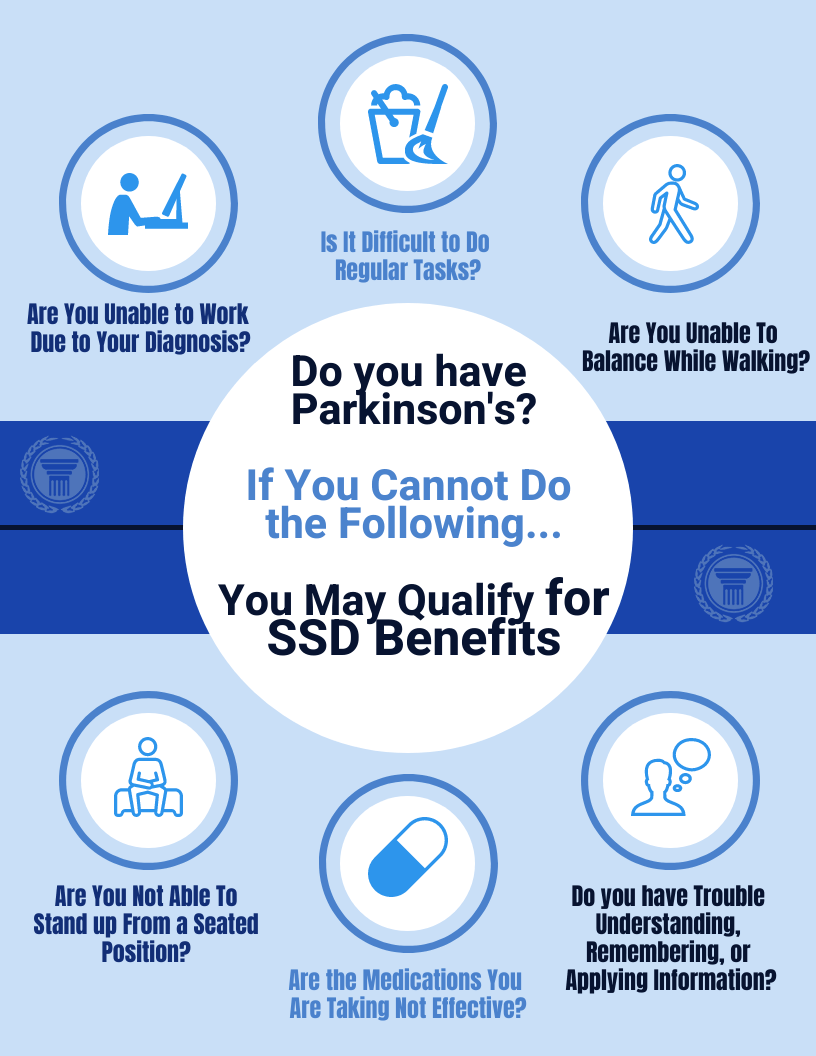

How To Qualify For Disability With Parkinson S Disease In 2022

How Many Hours Can I Work On Ssdi John Foy Associates

Doubling Down On Accessibility Microsoft S Next Steps To Expand Accessibility In Technology The Workforce And Workplace The Official Microsoft Blog

100 Legit Work From Home Jobs 2021 One Fine Wallet In 2021 Work From Home Jobs Legit Work From Home Legit Online Jobs

Disability Benefits Replace A Percentage Of Pre Disability Income If An Employee Is Unable To Work Due To Illne Disability Insurance Employee Benefit Tax Rules

Our Next Virtual Dance Workshop With Danceworks Is This Week Get Your Heart Pumping With This Upbeat Latin Inspired Work Dance Workshop Latin Inspired Upbeat

Love Is Assorted Colors Kids Babies Black Teespring In 2021 Babies Black Sweatshirts Crew Neck Sweatshirt

8 Sample Disability Forms Word Excel Pdf Templates Disability Form Word Template Words

Image Result For Activity For Disability Awareness School Report Card Essay Writing Essay Writing Help

Things Nobody Tells You About Filing For Disability Benefits Disability Benefit Social Security Disability Benefits Social Security Disability

How To Become A Transcriptionist In 9 Easy Steps How To Become Transcription Jobs From Home Medical Transcription